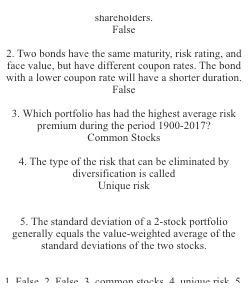

Q 1. A firm's total asset value belongs entirely to the shareholders. 2. Two bonds have the same maturity, risk rating, and face value, but have different coupon rates. The bond with a lower coupon rate will have a shorter duration. 3. Which portfolio has had the highest average risk premium during the period 1900-2017? 4. The type of the risk that can be eliminated by diversification is called 5. The standard deviation of a 2-stock portfolio generally equals the value-weighted average of the standard deviations of the two stocks.

View Related Questions